Market trends have a significant impact on property values, driven by factors such as demographic shifts, economic cycles, government policies, and technological advancements.

For example, the aging population and delayed homeownership among millennials are changing the housing market.

When interest rates rise, property values decrease because it becomes harder for people to afford homes.

Government policies and zoning laws control how land is used, affecting supply and prices.

Properties with sustainable and eco-friendly features increase in value, while urbanization drives growth in cities.

Understanding these trends is crucial for real estate professionals, investors, and policymakers as market forces continue to evolve and affect property values.

Shifting Demographics and Housing

The shifting demographics of the population, driven by aging baby boomers, millennials delaying homeownership, and increasing diversity, are changing the housing market and property values.

As the population gets older, there is a growing need for intergenerational housing, where multiple generations of families live together. This trend is more common in multicultural neighborhoods, where extended family structures are more common. In fact, 64% of Americans believe that living with multiple generations under one roof is good for family relationships.

This demographic shift has significant implications for property values. As demand for intergenerational housing increases, properties that cater to this need are likely to increase in value.

Multicultural neighborhoods, which often have higher levels of diversity and density, tend to have higher property value growth rates. In fact, a study found that neighborhoods with higher levels of diversity tend to have higher property values, attracting a diverse range of buyers and renters.

As demographics continue to change, it is essential to understand the implications for the housing market and property values.

Interest Rate Hikes and Values

Rising interest rates are pushing down property values. Higher borrowing costs make it harder for people to afford homes, which reduces demand. This leads to mortgage stress, lower property values, and even defaults.

The uncertainty of interest rate changes makes it hard for buyers to plan their mortgage payments. For every 1% increase in interest rates, housing prices can drop by up to 3%. This is especially concerning for homeowners already struggling with mortgage payments.

Rate volatility also reduces housing demand, as buyers become cautious about entering the market. As interest rates continue to rise, it’s essential to monitor their impact on property values and adjust investment strategies accordingly.

Understanding the relationship between interest rates and property values is crucial for making informed investment decisions in this volatile market.

Government Policies and Zoning Laws

Government policies and zoning laws have a significant impact on property values. They regulate how land is used, what type of buildings can be constructed, and how densely they can be built. This, in turn, affects the supply of housing and commercial spaces, which influences market prices.

Strict regulations can limit the amount of land available for development, driving up property values. On the other hand, lenient regulations can lead to an oversupply of housing, causing values to decline.

Changes to urban planning can also greatly affect property values. For example, reforms that encourage mixed-use development and density can increase property values by creating vibrant, walkable neighborhoods with access to amenities.

On the other hand, reforms that focus on single-family residential development can lead to more affordable housing options, but may also reduce property values due to the increased supply of housing stock.

Understanding how government policies and zoning laws impact property values is crucial for real estate professionals, investors, and policymakers who want to create thriving communities.

The Rise of Sustainable Living

As cities focus on density and mixed-use development, there’s a growing trend towards sustainable living. This shift is driving up property values in eco-friendly neighborhoods.

More and more people want to live in green buildings and eco-communities. In fact, homes in areas with high walkability scores and access to public transportation are selling for 10% more than similar homes in less sustainable areas.

Homes in eco-communities with green spaces and energy-efficient features can even sell for 5-7% more than similar homes in non-eco-friendly neighborhoods.

This trend is likely to continue, as 75% of millennials and Gen Z buyers prioritize environmental sustainability when buying a home.

To stay competitive, property developers and investors should focus on sustainable features in their projects. This can increase property values and give them an edge in the market.

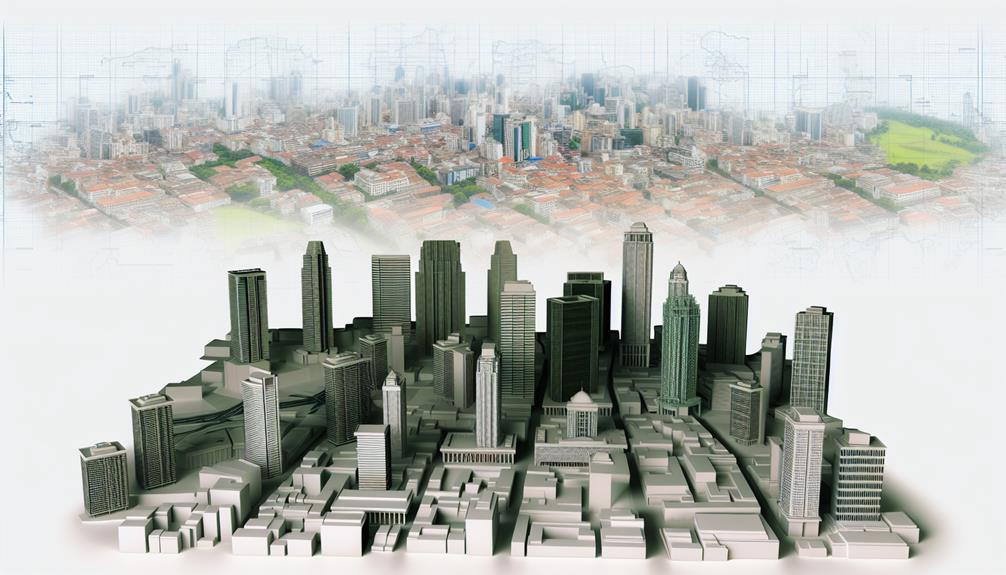

Urbanization and City Growth

Urbanization is changing the face of city growth, and this trend has significant implications for property values and investment opportunities.

As more people move to cities, urban areas are experiencing rapid growth. This growth is driving efforts to revitalize cities, with investments in infrastructure and amenities to attract residents and businesses.

However, this growth also leads to urban sprawl, where cities expand outward, putting pressure on resources and infrastructure.

The impact of urbanization on property values is complex. On the one hand, properties near city centers and amenities tend to increase in value, driving up demand and prices.

On the other hand, urban sprawl can lead to decreased property values in outlying areas, as services and amenities become less accessible.

For investors, it’s crucial to understand these dynamics when evaluating opportunities. The impact of urbanization on property values varies greatly depending on location and context.

Economic Cycles and Market Fluctuations

Economic cycles, which involve periods of growth and decline, significantly impact market fluctuations and property values.

Most economists agree that these cycles affect market sentiment, which in turn affects property demand and prices. When the market is growing, people are optimistic, and property values rise. On the other hand, when the market is declining, people are pessimistic, and property values fall.

During growth periods, prices can rise rapidly, creating bubbles. Eventually, these bubbles burst, causing market corrections and decreasing property values.

For example, the 2008 global financial crisis was caused by a housing market bubble that burst, leading to a sharp decline in property values.

Understanding economic cycles and their impact on market sentiment is crucial for investors and policymakers who want to minimize the effects of market fluctuations on property values.

The Impact of Global Events

Global events like wars, natural disasters, and pandemics greatly affect the real estate market, causing property values and investor confidence to fluctuate.

These events create uncertainty, leading to a decrease in property values and investor confidence.

Geopolitical uncertainty from wars and political upheaval can decrease foreign investment, negatively impacting property values.

Natural disasters like hurricanes and wildfires can physically damage properties, decreasing their value and increasing insurance costs.

Pandemics like COVID-19 change consumer behavior, shifting demand towards certain types of properties, such as homes with dedicated office spaces.

Staying informed about global events helps investors and property owners make informed decisions and adapt to changing market conditions.

Changing Lifestyles and Space Needs

Changes in lifestyles and technology are affecting what we need from our spaces, which in turn affects property values.

The rise of freelance and remote work has increased the demand for co-working spaces, changing the traditional office concept. This shift has led to higher commercial property values, especially in busy urban areas.

Additionally, the growing popularity of shared living, such as co-living spaces, is redefining residential property. Millennials and Gen Z prioritize community, flexibility, and affordability over traditional homeownership, driving this trend.

As a result, property values in areas with many shared living spaces are increasing significantly. Studies show that properties near co-working spaces and shared living arrangements are worth 10-15% more than those without.

This trend is expected to continue, with property values adapting to the changing needs of the modern workforce.

Technological Advancements and Homes

As smart home technology advances, it’s becoming a major selling point for properties.

Homebuyers and homeowners alike are looking for homes with integrated automation systems, which drives up demand and property values in areas with a high concentration of tech-savvy residents.

This is especially true in urban areas, where proximity to tech hubs and startups creates a high demand for smart homes.

Smart home features like voice-controlled appliances and energy-efficient systems are now a top priority for buyers.

The rise of virtual tours has also changed the home-buying process, allowing buyers to remotely inspect properties and making it easier for sellers to showcase their properties’ unique features.

Some key technological advancements driving property value growth include:

- Widespread adoption of smart home devices like Amazon Alexa and Google Home

- Advancements in virtual and augmented reality, enabling immersive virtual walkthroughs

- Integration of energy-harvesting systems and sustainable building materials in new constructions

Local and Regional Market Trends

Most metropolitan areas in the US have seen steady growth in property values over the past five years. This is mainly because of local economic factors and regional market trends.

Efforts to revitalize local areas have led to more investment in infrastructure, education, and healthcare. As a result, many areas have seen new businesses, job opportunities, and population growth, which has driven up property values.

In coastal areas, gentrification has been a big factor in shaping local market trends. Wealthy buyers and investors are moving to desirable coastal areas, causing property values to skyrocket.

This influx of new residents has increased demand for housing, pushing prices up and making it difficult for long-time residents to afford homes.

Inland areas, on the other hand, have seen more modest growth, with property values increasing at a slower pace.

Understanding local and regional market trends is crucial for investors, developers, and policymakers who want to take advantage of growth opportunities or mitigate the negative effects of gentrification.

Conclusion

Market Trends and Their Impact on Property Values

Demographic changes, such as aging populations and urbanization, affect property values. For example, areas with many retirees may see higher demand for senior-friendly housing, driving up property values.

When interest rates rise, borrowing costs increase, reducing demand and decreasing property values.

Government policies and zoning laws can either boost or hinder property value growth. Relaxed zoning laws, for instance, can lead to increased development and higher property values.

The shift towards sustainable living has increased demand for eco-friendly properties, driving up property values for homes with green features.

As cities grow, property values increase due to higher demand for housing and commercial spaces.

Global events like economic downturns or natural disasters can negatively impact property values.

Changes in lifestyle, such as the rise of remote work, influence property values as people seek homes with dedicated workspaces.

Advances in smart home technology increase property values by providing added convenience and energy efficiency.

Local and regional market trends, such as gentrification or suburbanization, significantly impact property values.

In summary, various market trends significantly influence property values. Notably, homes with solar panels sell for 4.1% more than similar homes without solar panels, highlighting the growing demand for sustainable living.

Leave a Reply

You must be logged in to post a comment.